With evolving sanctions policies and the increasing complexity of global trade, businesses must continuously refine their trade compliance processes to meet regulatory requirements.

Complying with sanctions enforced by The U.S. Office of Foreign Assets Control (OFAC) is mission-critical for any organization with international operations. One prospect recently shared, “Looking for help with our OFAC screening to comply with reporting requirements,” highlighting a common challenge organizations face—ensuring they meet regulatory obligations efficiently and cost-effectively. This company currently relies on manual screening methods which is risky, time-consuming, prone to human error, and lacks the detailed audit trail they need for compliance purposes.

OFAC compliance software plays a crucial role in streamlining sanctions screening, improving recordkeeping, reducing manual workload, and mitigating trade compliance risks. However, pricing remains a key factor in the decision-making process. How much should businesses expect to invest? What pricing models exist? And most importantly, how can organizations balance costs with comprehensive compliance coverage?

In this article, we’ll break down the costs associated with OFAC compliance software, explore key pricing considerations, and help you determine the best approach for your needs. While price is an important concern, it’s just one piece of the puzzle—choosing the right solution means weighing cost against factors like accuracy, automation, support, and integration capabilities.

In This Article:

- What Does OFAC Compliance Software do?

- How much does OFAC compliance software cost?

- Cost breakdown: what are you paying for?

- Hidden costs to be aware of.

- How to choose the best OFAC compliance solution.

- Understanding ROI: is it worth the investment?

- The cost of OFAC sanctions violations.

- The business benefits of OFAC compliance solutions

- Maximizing ROI and OFAC compliance.

What is OFAC Compliance Software?

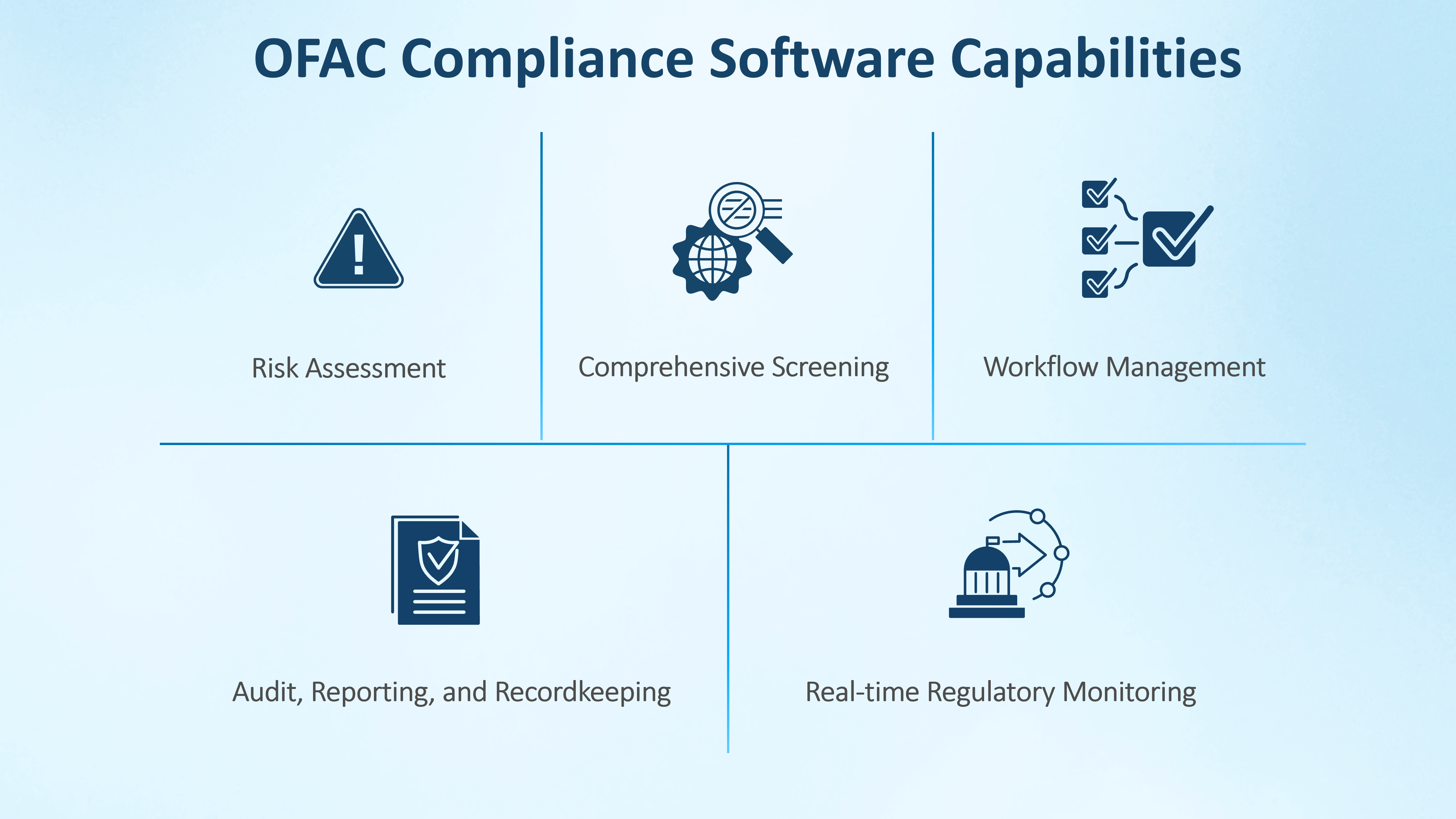

OFAC compliance software is a vital tool for organizations navigating U.S. sanctions regulations. This specialized software automates the process of screening individuals, entities, and transactions against OFAC sanctions lists, including the Specially Designated Nationals (SDN) list. It helps businesses ensure they are not engaging with prohibited parties, reducing legal and financial risks.

In a landscape where trade compliance is both a legal obligation and a strategic advantage, OFAC compliance software is an indispensable ally for maintaining trust, operational efficiency, and regulatory adherence.

Figure 1: Core Capabilities of OFAC Compliance Software

How Much Does OFAC Compliance Software Cost?

When it comes to the cost of OFAC compliance software, there isn’t a one-size-fits-all pricing. Instead, cost is as varied as the businesses and industries that need to comply with OFAC sanctions. So, how much does OFAC compliance software cost? Basic solutions start at $1,200 per year, mid-sized screening with automated workflows averages $2,500 annually, and enterprise-level systems with advanced features and complex integrations can exceed hundreds of thousands. The variation in OFAC compliance software pricing is based on factors like business size, number of users, screening volume, required features, and customization needs. While not all trade compliance vendors price the same way, typical pricing models include:

- Subscription-based Plans (monthly or annual fees) – you may prefer a predictable recurring cost model but pay attention to the billing frequency as monthly payments are usually higher than annual subscriptions. Additionally, some vendors offer tiered pricing based on a fixed number of denied party screenings. An OFAC screening package could look like ‘screen up to 1,000 customers / entities for $100 per month’. It is important to note that packages like these often offer only basic name check functionality without proper reporting or integration support, and screening additional entities outside of the subscription allowance attracts a high surcharge.

- Pay-per-transaction Screening Options – in this pay-as-you-go model, the vendor charges for each OFAC search that is performed and they may also charge for each OFAC sanctions list that is screened against. Prices range from $0.20 to $1 per transaction screening, but most providers require minimum order volumes. This may be ideal for businesses processing small transactions, but costs can quickly scale with an increase in screening volume.

- Fully Customized Enterprise Solutions – organizations often require customized solutions tailored for complex OFAC compliance needs, such as multi-jurisdictional screening. When considering this model, evaluate the customization depth offered by the vendor to confirm that the solution can be adapted to specific workflows and OFAC compliance requirements.

- Modular Pricing – this model offers the most flexibility and helps organizations only pay for what they need with an option to scale as required. With modular pricing, there are add-on costs for additional features to boost capabilities.

Free OFAC screening tools exist, like those offered on OFAC’s website. This may be suitable for organizations with very low screening volumes (less than 10 a year) but they often require manual processing, lack automation, and offer limited screening capabilities, making them insufficient for businesses with high trade compliance demands.

Breakdown of OFAC Compliance Software Cost: What You’re Paying For

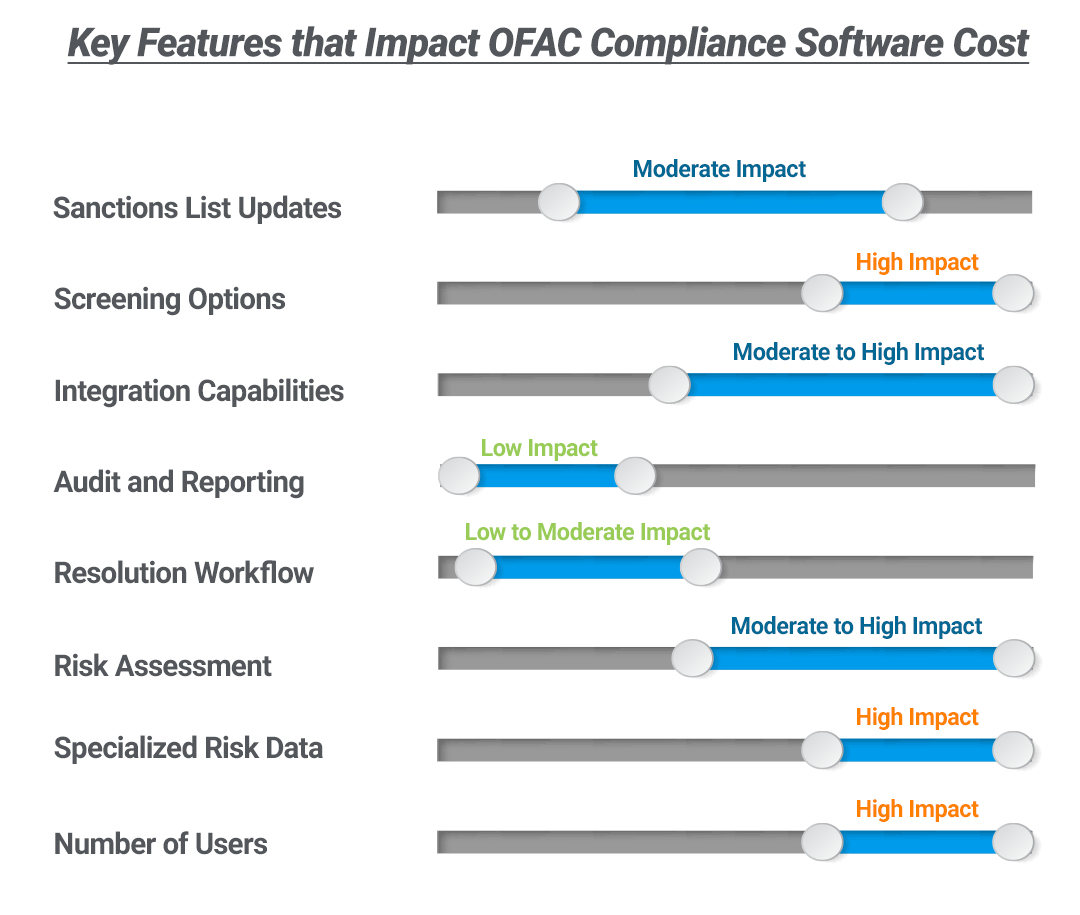

What exactly are you paying for with an OFAC compliance solution? The upfront price is often only the beginning, and the final cost can be higher than expected. With many providers lacking detailed pricing structures and being vague about potential hidden costs — such as setup fees, maintenance charges, or additional processing fees — budgeting can be very tricky. Understanding how core features impact pricing is essential, as these capabilities determine your organization’s ability to meet compliance obligations effectively. So, what core features affect OFAC compliance software pricing? Let’s break it down:

- Real-time Sanctions List Updates: sanctions lists significantly shape the functionality and importance of OFAC compliance software. Working with updated lists is essential to safeguard operations. Depending on the vendor, this may have a low impact on pricing, especially if included in the package — as it’s an expected capability.

- OFAC Screening Options: Flexible screening capabilities enable organizations to maintain compliance effectively while adapting to their unique operational and regulatory requirements.

- Ad Hoc OFAC sanctions list search: Also called online screening, with this option OFAC sanctions search is conducted on a case-by-case basis. This is often the most cost-effective and typically suitable for smaller organizations or low-volume needs.

- Batch sanctions screening: Allows for the simultaneous review of multiple entities, suitable for medium to high-volume needs. It is an indispensable tool to have at the start of your compliance journey or during an acquisition to screen customers/entities already in the system.

- Continuous / Dynamic rescreening: Provides real-time, ongoing screening of transactions and entities. It ensures that new risks are identified and addressed promptly.

These features offer significant value and typically have a low to mid impact on pricing, but your operations may require a combination of options to provide thorough risk management.

- Integration Capabilities: Integrating your OFAC compliance platform with existing systems, such as CRMs and ERPs, can streamline workflows and provide comprehensive coverage. The impact on pricing varies based on your needs; off-the-shelf integrations with popular CRMs such as OFAC screening within Salesforce may be cost-effective, but custom integrations can be more expensive.

- Audit Trails and Reporting Tools: Audit trails are crucial for meeting regulatory recordkeeping requirements, especially with OFAC’s new 10-year recordkeeping mandate. These features generally have a low impact on pricing but are invaluable for compliance.

- Resolution and Escalation Workflow: These features streamline the process of managing potential matches or flagged transactions by providing structured steps for investigation, escalation, and resolution. They are valuable for promoting efficiency, consistency, and collaboration. Leading vendors may include resolution workflows in their standard package, potentially reducing the total cost compared to vendors with lower upfront pricing who charge extra for this functionality.

- AI-powered Risk Assessment: OFAC compliance software that leverages artificial intelligence and machine learning enhances the effectiveness of sanctions screening and risk mitigation, making it a worthwhile investment. Features like automated risk scoring, predictive analytics, and contextual analysis identify compliance risks, reduce false positives, and improve responsiveness. While these features can elevate the cost of solutions, industry-leading providers like Descartes include AI Assist capabilities in their standard product roadmap. This ensures immense value while lowering the impact on pricing.

- Specialized OFAC Compliance Risk Data: Enhanced due diligence data and risk mitigation features often come at an additional cost due to the specialized nature of the content — for example, comprehensive sanctioned party ownership data required to comply with the OFAC 50% Rule. This type of premium data typically curated only by dedicated specialized firms and, as such has a high impact on the final pricing.

- Number of Users: Many OFAC compliance software providers charge per user or offer tiered pricing based on the number of users. More users typically mean higher licensing costs. Determine the exact number of users who require access and avoid overestimating. Supporting a larger user base may require more robust infrastructure, which can increase development and implementation costs.

Figure 2: Key Features and Their Impact on OFAC Compliance Software Pricing

Potential Hidden Costs You Should Be Aware Of

Potential hidden costs in OFAC compliance software that organizations often overlook and which they find frustrating include:

- Implementation and Setup Fees: Costs associated with setting up and integrating the software into your existing infrastructure.

- Scalability Costs: Expanding the software to accommodate more users, higher transaction volumes, or additional features can lead to significant price increases. Solutions that easily support growth and handle increasing data volumes may have higher initial costs but offer long-term value compared to cheaper options.

- Training and Support: Ensuring your team is proficient with the new system is vital. Leading vendors often provide training and resources at no extra cost.

- Ongoing Updates: To adapt to evolving regulations, regular updates are necessary. Most vendors include this in their subscription fees, while others may charge separately.

- Compliance Penalties: If the software lacks critical features, organizations may need to supplement it with manual efforts, increasing labor costs and the risk of non-compliance penalties—an indirect but significant expense.

These hidden costs can impact the overall pricing and value of the software, making it essential to carefully evaluate contracts, ask detailed questions about pricing structures, and select the right solution based on more than just cost.

How do I Choose the Best OFAC Compliance Solution?

The best OFAC compliance software is the one that aligns with your operational and regulatory requirements. Here are key steps to guide your selection approach:

- Assess your business needs: The journey to finding the right solution begins with a thorough analysis of your business. Evaluate your organization’s size, industry-specific risks, transaction volumes, and existing compliance workflows. Know who, when, where, and how you need to screen to stay compliant.

- Engage with proven OFAC compliance vendors: Ask critical questions such as: What sanctions screening lists do they cover? How frequently are they updated? Do they offer automated workflows or integrations? Are audit and reporting features provided?

- Utilize free trials and demos: These are invaluable in testing the software’s core functionalities, usability, and overall performance. This hands-on experience will clarify whether the solution addresses the questions you ask.

- Consider customization and scalability: Ensure the solution can adapt to your business’s growth and evolving regulatory requirements.

Comparison of OFAC Compliance Software Solutions

There are several vendors to consider when searching for the right OFAC compliance solution. To compare vendors and solutions effectively, start by reading reviews and testimonials on platforms like G2 or Capterra to understand user experiences. Consider vendors with a proven track record in various industries, especially yours, and across different company sizes. Focus on providers specializing in OFAC compliance and denied party screening solutions, with vital features like ‘address-only’ screening.

Prioritize vendors that demonstrate flexibility to cost effectively scale with your business and offer additional trade compliance solutions, such as export license management. Keep in mind that pricing details are often not openly disclosed, so it may be difficult to compare costs directly. Let the software’s value, ease of use, and alignment with your needs guide your decision.

ROI of OFAC Compliance Software: Is It Worth the Cost?

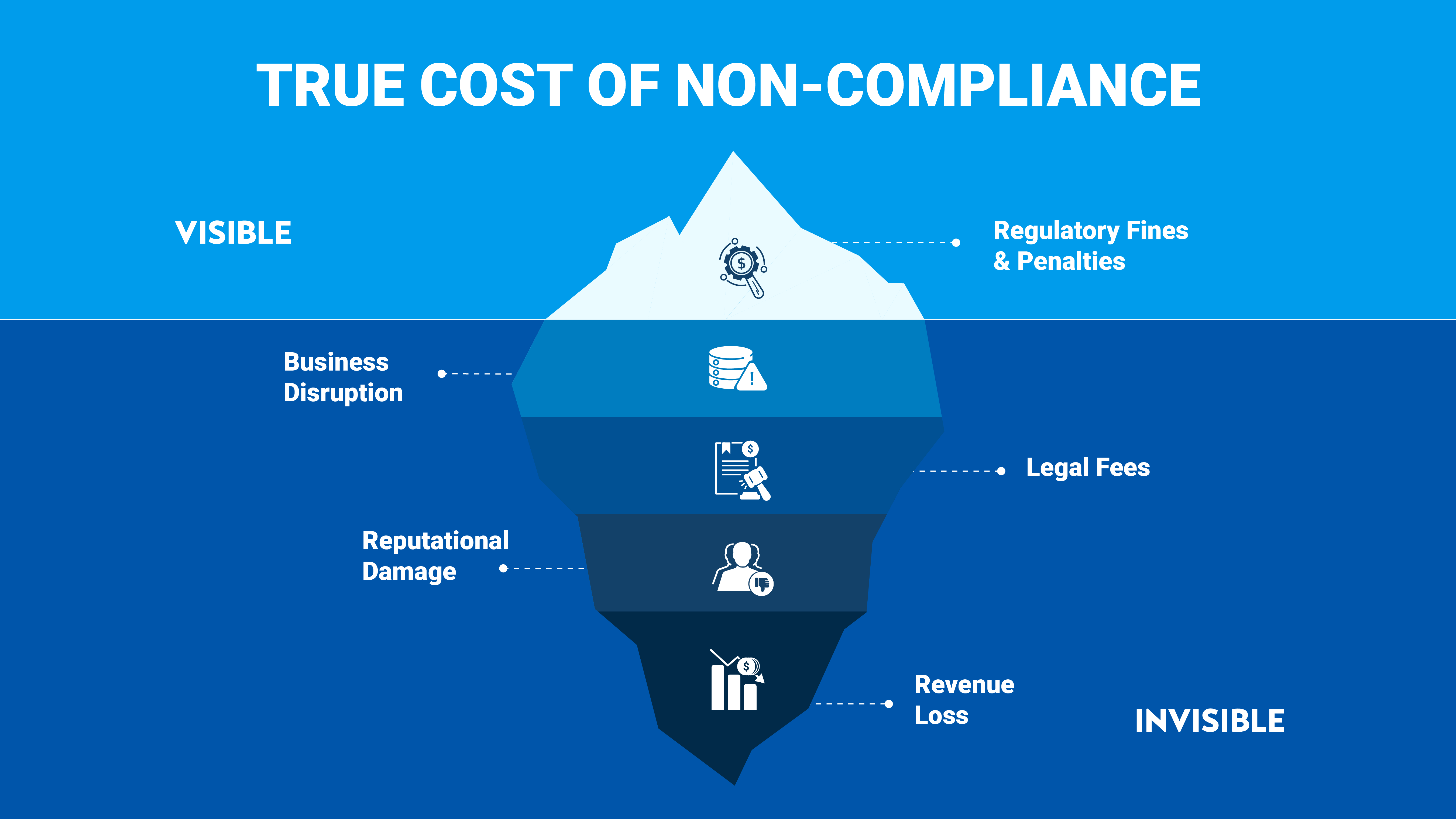

Investing in OFAC compliance software often raises concerns about return on investment (ROI) due to upfront and recurring costs. Since compliance programs are not typically revenue generators, demonstrating ROI to decision makers can be challenging. However, the cost of non-compliance far outweighs the expense of implementing robust solutions.

To evaluate ROI, it’s essential to first understand the cost of non-compliance and the risks you’ll be mitigating. Beyond this primary benefit, the right solution can also enhance several aspects of your business operations.

The Cost of Non-Compliance with OFAC Sanctions

We’ve been focusing on OFAC compliance software costs, but how much does non-compliance cost? This varies based on the severity and number of violations, mitigating or aggravating factors, the specific sanctions violated, and the value of transactions involved.

Recent OFAC penalties highlight this stark reality. For example, a global industrial equipment supplier faced over $14 million in fines for sanctions violations. Such penalties, coupled with reputational damage and operational disruptions, can cripple businesses.

Let’s examine another example to compare the costs of non-compliance versus proactive OFAC sanctions check:

- $22,172 Fine: An aircraft supply company failed to rescreen customers recently added to the OFAC SDN list, resulting in six apparent violations of Russia sanctions.

- For a company this size, an OFAC compliance solution with dynamic, continuous screening would cost an average of $3,800 per year—less than 20% of the OFAC fine. Beyond the penalty, there are also legal and operational expenses to remediate violations.

Even at the lower end of fines, OFAC screening software quickly pays for itself by preventing a single, relatively small fine. Imagine how much might be saved by preventing a dozen non-compliant actions?

Figure 3: True Cost of Non-Compliance: Fines are Just the Tip of the Iceberg

The Business Benefits Beyond Preventing OFAC Penalties

Fees are certainly the stick, but there are plenty of carrots that make adopting OFAC compliance software well worth the investment, such as:

- Operational efficiency: Automates OFAC compliance tasks, reducing time and resources spent on manual workflows and allowing teams to focus on high-priority risks.

- Reduced false positives: Advanced algorithms decrease false alerts, helping compliance teams stay focused on genuine risks and improving decision-making speed.

- Boosts Customer Satisfaction and Sales Performance: Faster due diligence processes expedite onboarding and transaction approvals, while reduced administrative bottlenecks allows sales teams to focus on driving revenue.

- Improved accuracy and consistency: Standardizes compliance checks, ensuring they happen as scheduled with minimal manual involvement, with real-time data updates, reducing human errors and discrepancies.

- Effective risk management: Proactively identifies and mitigates compliance risks by staying updated with regulatory changes and OFAC sanctions lists.

- Scalable compliance: As businesses grow and enter new markets, robust OFAC compliance software adapts to increased volumes and regulatory complexities.

- Data-driven decision-making: Provides insightful analytics and reporting to identify risk trends and optimize resource allocation for strategic planning.

Maximize OFAC Compliance and Minimize Risk with Descartes

For businesses engaged in international trade or financial transactions, meeting OFAC compliance requirements is not optional—it’s essential. When choosing OFAC compliance software, it’s important to look beyond the price tag and focus on the value it brings to your business

Descartes OFAC compliance solutions are designed to help businesses navigate regulatory complexities. From automated denied party screening and transaction monitoring to secure record management and sophisticated reporting and analytics, our solutions offer the tools needed to streamline trade compliance processes, ensure accuracy, and reduce the risk of violations.

Ready to find the best fit? Contact us today for a demo and more expert insights on pricing, performance, and how a best-in-class partner can simplify OFAC compliance.

Find out what our customers are saying about Descartes Denied Party Screening on G2 – an online third-party business software review platform. Additionally, you can read this essential buyer’s guide to denied party screening to help you select a solution that fits your needs.